The practical matters of personal finance for freelancers.

You might remember some time ago I started working on a book about personal finance together with my friend Mike Katzmann, a financial advisor by day and an avid dancer by night.

As you might have noticed, the project hasn’t materialized so far and a couple of weeks ago, I archived our Trello board acknowledging it wasn’t the right time for me to work on it. Yet. (Hopefully, anyway.)

I remember turning 30 and thinking to myself I should really take matters in my own hands and actually think about money and how to approach the topic in the long-term.

Two years have passed since. I’ve read a number of books and got an idea on how to approach the whole thing, yet haven’t executed on anything yet. Luckily, and in the meantime, I’ve moved back to Berlin, which has proven to be the much needed push to actually radically recalibrate my habits.

I finally have a system for how I manage my money that’s fun and motivating me to actually (!) put money aside. Maybe this email will inspire you in one way or another. Or, which would be even better for me, you’ll hit reply and share your tips, tricks, and strategies with me. :)

How I use bank accounts

First of all, I have two separate bank accounts. I have a business account with a traditional German bank, which is where I receive all incoming payments and use for all business expenses. Then, I also have a private account. My personal account is with N26, which I absolutely love and would recommend any day! (If you consider signing up, please use my referral code – monikak3108 – which will give us both a €15 bonus.)

Recently, N26 introduced an incredible new feature and I couldn’t be happier! Customers can now create sub-accounts called spaces that enable them to assign a purpose to each. (mint.com does this in the US). One can also set a saving goal and see one’s progress. In the past couple of months, I’ve gamified how I use spaces, which is something I thought I’d share.

Next to my main account, I have the following sub-accounts:

A freelancer fund I’m aiming to save up the equivalent of how much I need for three months. My plan is to get to that goal and once I do, I’ll start paying towards my investment fund.

An investment fund where I plan to save up €2.000 and once I have that, get back to the book on investing my friend Clemens Bomsdorf wrote. (I do have a considerable amount of friends working in finance now that I’m thinking about it.)

A holiday fund. I’ve set a goal of €3.000, which I know is enough money to cover flights, accommodation, and all my expenses to leave on a vacation for one month.

A relationship fund where I put money aside whenever someone pays for something I could have also paid for myself.

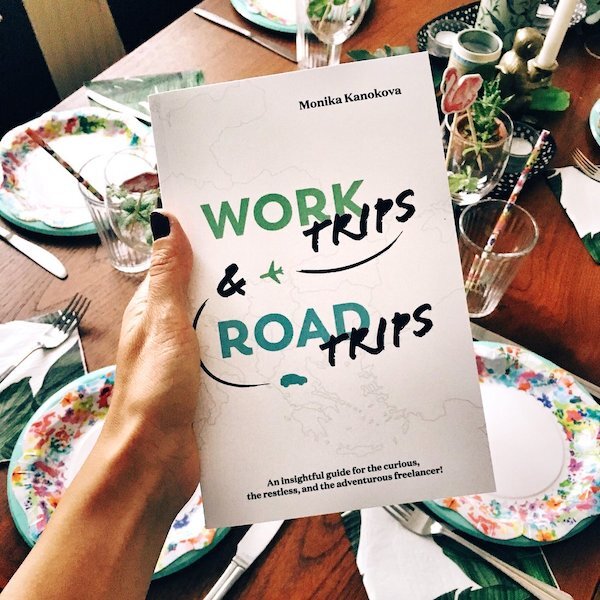

And a monthly savings account. I mentioned in Work Trips and Road Trips that I keep track of how much I spend every day. Whenever I spend less than €30 in a day, I move the difference into this space for me to see at the end of the month how much I put aside. On the first of each month, I move all the money from this space and also what’s left on my main account to one of the saving spaces. (Which at this point is my FreelancerFund or as my friend Theresa Lachner would call it, My Fuck You Fund). Btw. And if I haven’t mentioned it anywhere else, it’s a saving space you create to build up a safe blanket so that when you face a dry month, you don’t panic about it.

How I manage my money as a freelancer

The advantage of me freelancing is that I earn money from different sources. I find this quite handy because it makes allocating money to my sub-accounts much more fun. I do that as follows:

I transfer 45% of everything I’ve earned from my business account to my private account. I’m keeping 55% on my business account to cover all my business expenses, taxes, and health insurance. On my private account, I split the money as follows:

I transfer…

40% of what I earn from my main client I keep as spending money.

5% of what I earn from my main client I immediately transfer to the FreelancerFund. In case I have another somewhat larger project going on, I move all of the 45% I earn with them to the FreelancerFund as well.

45% of all earnings I make from my books, my webinars on Skillshare, my photos I sell on EyeEm, and from small one-off projects I move to the HolidayFund.

Learn more about diversifying your income streams:

If you feel like you too might want to consider creating multiple income streams, I’ve recently published three Skillshare classes to help with that:

Watch editing and monetizing your smartphone photos to learn more about how I monetise the pictures I take on the go.

If you’d like to set up a project but don’t know quite know how, I’ve put together a step by step class to help you come up with side projects to eventually monetize them.

And given we’re talking about monetization, you might also want to check out my class on Kickstarter and how to use the platform to finance creative projects.